Introduction

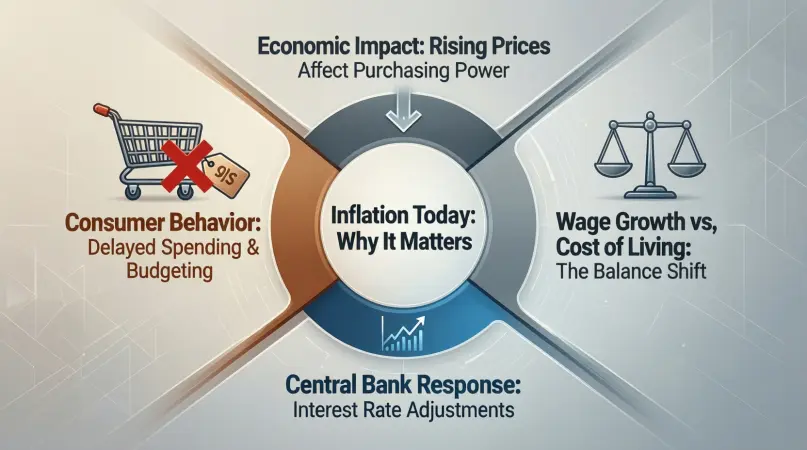

Inflation news today is one of the most discussed topics in the world of finance and economics. Every day, people hear about rising prices, changes in interest rates, and government actions aimed at controlling inflation. For beginners and intermediate readers, this constant flow of information can feel confusing and sometimes overwhelming. However, understanding inflation news today is very important because it directly affects daily life, savings, businesses, and future planning.

Inflation simply means an increase in the general price level of goods and services over time. When inflation rises, the same amount of money buys fewer items than before. Because of this, inflation news today is closely watched by households, investors, policymakers, and business owners. Even small changes in inflation numbers can influence markets and public confidence.

In recent times, inflation news today has gained more attention due to global economic challenges, supply chain disruptions, energy prices, and changing monetary policies. News headlines often highlight inflation rates, food prices, fuel costs, and central bank decisions. These updates help people understand where the economy is heading and what steps they might need to take.

This article explains inflation news today in simple English. It covers what inflation is, why it matters, how to read inflation updates step by step, and the benefits and risks involved. By the end, you will have a clear picture of how inflation news today impacts your money and your future decisions.

What Is Inflation News Today?

Inflation news today refers to the latest reports, updates, and analysis about changes in prices across an economy. These updates usually focus on inflation rates, price trends, and official data released by government agencies or central banks.

Inflation news today often includes information about consumer prices, producer prices, and core inflation. Consumer prices track what households pay for daily items like food, transport, and housing. Producer prices focus on costs faced by businesses. Core inflation removes volatile items such as food and energy to show long-term trends.

In simple terms, inflation news today tells us whether prices are rising slowly, quickly, or staying stable. It also explains why these changes are happening and what actions authorities may take in response.

Why Is Inflation News Today Important?

Inflation news today is important because it affects almost everyone. From household budgets to business profits, inflation plays a key role in economic stability.

When inflation is high, people struggle to afford basic needs. When it is too low, economic growth can slow down. Inflation news today helps people understand this balance and prepare for changes.

Governments and central banks also rely on inflation news today to adjust policies. Interest rates, taxes, and spending decisions often depend on inflation trends. Therefore, following inflation news today helps individuals make informed financial choices.

Detailed Step-by-Step Guide

Step 1: Understanding Inflation Data

The first step in following inflation news today is understanding the data being reported. Inflation rates are usually shown as percentages, comparing current prices to the same period last year.

A higher percentage means faster price increases. A lower percentage suggests slower growth or stability. Learning to read these numbers helps make sense of headlines.

Step 2: Identifying Key Inflation Indicators

Inflation news today often mentions indicators like CPI and PPI. The Consumer Price Index measures changes in household expenses. The Producer Price Index measures costs at the production level.

Both indicators provide useful insights. CPI affects consumers directly, while PPI can signal future changes in consumer prices.

Step 3: Analyzing Causes of Inflation

Inflation news today usually explains why prices are rising or falling. Common causes include demand growth, supply shortages, higher wages, and increased energy costs.

For example, if fuel prices rise, transportation costs increase, leading to higher prices for many goods. Understanding these causes helps readers judge whether inflation is temporary or long-lasting.

Step 4: Monitoring Central Bank Actions

Central banks play a major role in inflation control. Inflation news today often covers interest rate decisions and policy statements.

When inflation rises too fast, central banks may increase interest rates to reduce spending. When inflation is low, they may lower rates to encourage growth.

Step 5: Observing Market Reactions

Inflation news today also affects financial markets. Stock markets, currency values, and bond yields often react to inflation updates.

Learning how markets respond helps investors and savers adjust strategies wisely.

Step 6: Applying Inflation News to Personal Decisions

The final step is using inflation news today in daily life. Budgeting, saving, investing, and salary negotiations can all be influenced by inflation trends.

For example, during high inflation, people may focus on reducing expenses and protecting savings from losing value.

Benefits of Inflation News Today

- Helps people understand changes in living costs

- Supports better financial planning and budgeting

- Guides investment and saving decisions

- Increases awareness of economic conditions

- Encourages informed discussions about policy

- Helps businesses plan pricing and wages

Disadvantages / Risks

- Can cause fear and panic if misunderstood

- Short-term news may be misleading

- Overreaction to headlines can lead to poor decisions

- Complex data may confuse beginners

- Constant exposure may increase financial stress

Common Mistakes to Avoid

One common mistake is focusing only on headlines without reading details. Inflation news today often needs context to be understood correctly.

Another mistake is assuming inflation affects everyone the same way. Personal spending patterns matter. Ignoring long-term trends and reacting only to monthly changes is also risky.

Lastly, many people forget to connect inflation news today with their own financial goals, missing opportunities to adapt wisely.

FAQs

What does inflation news today usually report?

Inflation news today reports changes in price levels, inflation rates, and economic analysis. It explains how prices of goods and services are moving.

How often is inflation data released?

Most inflation data is released monthly. However, some indicators are published quarterly or annually.

Why do prices rise during inflation?

Prices rise due to higher demand, increased production costs, or supply shortages. Inflation news today explains these factors.

How does inflation affect savings?

Inflation reduces purchasing power. Savings lose value if interest rates are lower than inflation.

Can inflation be controlled?

Yes, through monetary and fiscal policies. Central banks and governments use tools to manage inflation.

Should beginners follow inflation news today?

Yes, because it helps understand money, budgeting, and economic conditions in simple terms.

Expert Tips & Bonus Points

Experts suggest focusing on long-term inflation trends rather than daily noise. Reading multiple sources improves understanding.

Another tip is to link inflation news today with personal goals. Adjust budgets, investments, and savings plans accordingly.

Staying calm and informed helps avoid emotional decisions during high inflation periods.

Conclusion

Inflation news today plays a vital role in shaping how people understand the economy and manage their finances. While the topic may seem complex at first, breaking it down into simple ideas makes it easier to follow. Inflation affects prices, savings, wages, and business decisions, which is why staying informed is so important.

By understanding inflation news today, beginners and intermediate readers can make smarter choices. Knowing why prices change, how governments respond, and what trends mean helps reduce uncertainty. Instead of reacting emotionally to headlines, informed readers can focus on long-term planning.